The U.S. Department of the Treasury has unveiled a policy brief titled “Financing Small Business: Landscape and Recommendations.”

This brief highlights the evolving dynamics of small business financing and underscores Treasury’s commitment to supporting small businesses, which drive economic growth.

This summary comes from a roundtable discussion organized by the Office of Financial Institutions Policy. Key stakeholders discussed how technology and AI are reshaping small business financing, and their insights informed the report’s findings and recommendations.

The document explores trends, challenges, and opportunities in the financing landscape.

It examines the growing role of non-bank financial technology providers and addresses barriers small businesses face, especially in underserved communities.

Barriers to Access and the Changing Landscape of Financing

Small business owners face difficulties navigating the financial product market.

Many products, such as those with variable terms or hidden fees, lack transparency, and options like merchant cash advances and factoring complicate comparisons.

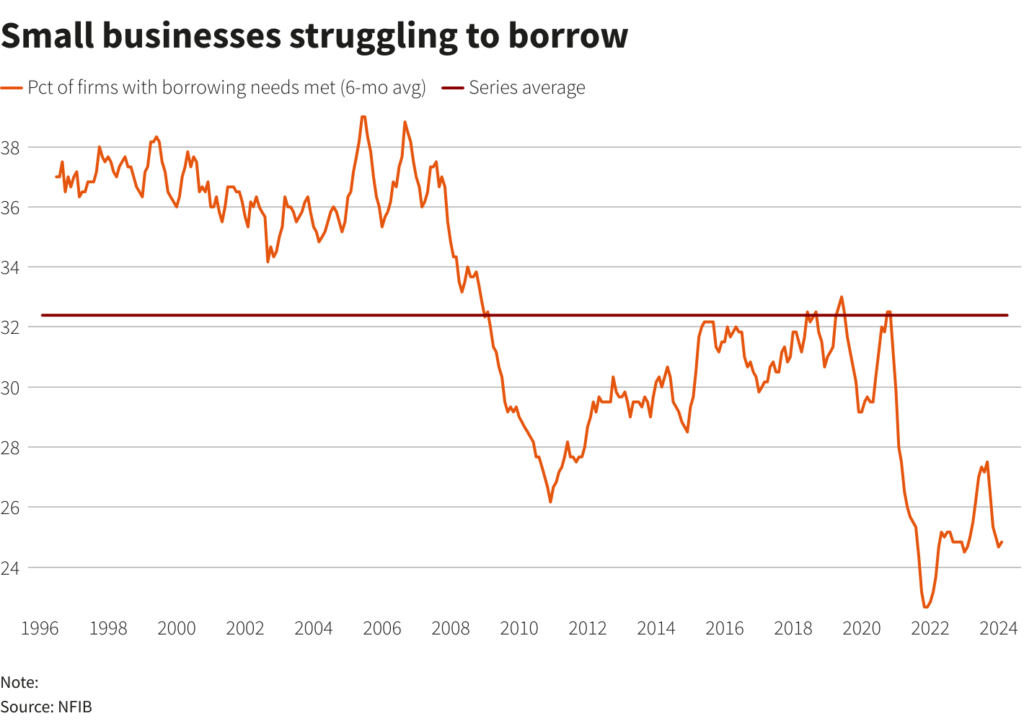

Over the past decade, large banks have tightened credit standards, reducing the number of small business loans they originate.

Meanwhile, fintech lenders have expanded their role, filling gaps left by traditional banks.

Community banks and mission-driven lenders have remained crucial. Institutions like Community Development Financial Institutions (CDFIs) support underserved populations, and programs such as the State Small Business Credit Initiative (SSBCI) have strengthened these efforts.

Despite these efforts, significant gaps persist. Underserved business owners often face unique challenges. They may lack personal resources and connections to capital providers or face cultural barriers.

Recommendations for Policymakers and Capital Providers

The Treasury recommends that policymakers maintain dialogue with industry stakeholders, evaluate small business needs, and expand financing options.

Collaboration is key to creating a more equitable financial ecosystem.

Capital providers must deepen their commitment to small business financing. They should leverage government programs like Small Business Administration (SBA) initiatives.

These programs can help providers reach more businesses while managing risks prudently.

According to the Treasury, uniform product disclosures are critical. Policymakers should study the benefits of standardizing terms across financial products.

Standardized disclosures help businesses compare options and make better decisions.

The Treasury encourages voluntary action by capital providers. They should adopt clear and consistent disclosure practices. It would ensure small business owners understand repayment terms, fees, and other essential details.

Regulators must coordinate efforts to support small business financing. They should collaborate with the Treasury and other agencies to create comprehensive resources to help business owners navigate financing options.

Emerging technologies like AI need consistent standards. Regulators must ensure financial institutions deploy these tools responsibly.

Robust standards will protect small businesses while enabling innovation.

The Treasury’s policy brief marks a significant step forward. It addresses challenges in accessing capital and promotes transparency. The recommendations aim to create a dynamic and inclusive financial ecosystem.

Collaboration among policymakers, regulators, and industry stakeholders is essential. This collaboration can bridge market gaps and ensure that small businesses have the resources to thrive.

Technology continues to reshape the financial landscape. Fintech innovations bring both opportunities and challenges. Policymakers must stay ahead to balance innovation with fairness.

The Treasury emphasizes the need for clear communication. Small business owners deserve straightforward, accessible information. This transparency will empower them to make informed choices.

Programs like SSBCI have proven effective but are not enough. More targeted efforts are needed to support underserved businesses. Expanding these programs could help fill existing gaps.

Underserved communities face persistent obstacles. Policymakers must address these challenges directly, and connecting these businesses to capital sources is a priority.

The Treasury’s recommendations provide a roadmap as the market evolves. They encourage inclusivity, transparency, and responsible innovation.

- 107shares

- Facebook Messenger

About the author

Andy Cale is a seasoned journalist and commentator with over a decade of experience covering global news and events. He specializes in delivering insightful opinions and in-depth analysis on current affairs, shedding light on the key issues shaping our world today.