As the tax season begins, Intuit Inc. unveils innovative services for taxpayers. The company, known for TurboTax, Credit Karma, QuickBooks, and Mailchimp, focuses on affordability and speed.

These new offerings aim to make tax refunds faster and more accessible.

Tax refunds often provide a significant financial boost for many Americans. On average, taxpayers receive over $3,000 in refunds.

This money covers necessities, reduces debt, or ensures financial stability for countless households.

Intuit understands the urgency of accessing refunds. Its new features prioritize speed and affordability and ensure taxpayers receive funds with minimal hassle.

Innovative Offerings for Faster Refunds and Financial Flexibility

One standout feature is the “5 Days Early Refund” service. It guarantees refunds up to five days before the IRS schedule. For a flat $25 fee, taxpayers enjoy early access to their refunds.

Unlike traditional systems, this service delivers refunds directly to any U.S. bank account. Funds transfer quickly without delays, and the fee is waived if delivery takes longer, ensuring reliability.

Additionally, taxpayers using a Credit Karma Money™ account get this service at no extra cost. It adds value for users seeking faster, affordable options, and this feature highlights Intuit’s commitment to accessibility.

Another highlight is the “Refund Advance” loan. This option offers immediate financial relief for those needing funds urgently.

Taxpayers can access up to $4,000 with zero fees or interest.

The loan is approved quickly, and funds are delivered within 60 seconds after the IRS accepts the filing. This ensures taxpayers can handle urgent expenses without impacting their credit scores.

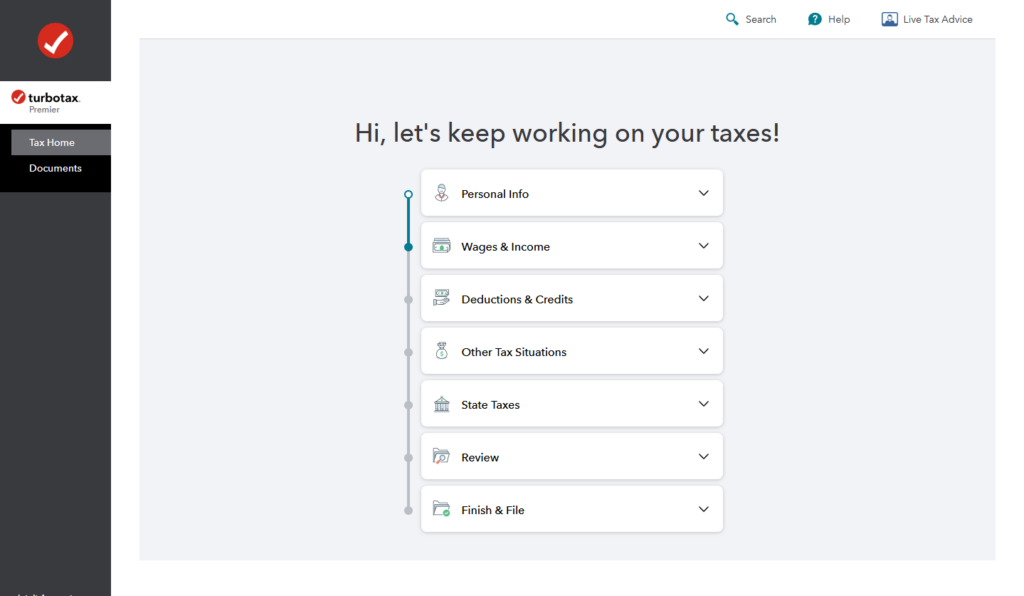

TurboTax also introduces free federal and state filing through its mobile app. First-time users and those who skipped TurboTax last year qualify. They can file taxes at no cost, regardless of complexity.

This free service runs until February 18, 2025. It remains the only comprehensive, free, do-it-yourself option available. TurboTax once again sets the bar high for tax preparation.

Meeting the Needs of a Changing Tax Landscape

Affordability extends to those seeking professional help. TurboTax’s Live Full Service offers a 10% fee reduction compared to last year’s tax professional rates.

This deal applies to taxpayers filing by March 25, 2025.

A recent survey highlights why these features matter. TurboTax and Talker Research found that 93% of Gen Z expects refunds this year, and many plan to use them for rent, food, and debt repayment.

The survey also revealed generational spending differences. Gen Z prioritizes investments like stocks, bonds, or cryptocurrency. Nearly 19% of Gen Z filers plan to invest, compared to only 6% of Baby Boomers.

Additionally, younger taxpayers tend to spend money on entertainment. Gen Z leads in using refunds for concerts and sporting events, while Baby Boomers show less interest in this category.

For many, faster refunds mean reduced financial stress. Over a third of respondents said earlier refunds help avoid late fees. They also allow for timely rent payments and improved peace of mind.

TurboTax’s features directly address these needs. Fast refunds, no-cost options, and tailored solutions empower taxpayers. Intuit’s approach simplifies tax season for all generations.

Looking ahead, Intuit continues to innovate in personal finance. Its offerings combine speed, affordability, and convenience, and TurboTax users gain greater control over their financial health.

The free mobile app makes filing more effortless than ever. Refund advances provide immediate funds without added costs, and assisted filing ensures professional help at competitive rates.

For more details, taxpayers can visit TurboTax’s website. The app is available in English and Spanish on both the App Store and Play Store. Credit Karma products are also accessible through the app.

- 107shares

- Facebook Messenger

About the author

Dennis Fort is a Certified Financial Accountant (CFA), Certified Financial Planner (CFP), and Certified Public Accountant (CPA) with a Master's in Business Administration from the University of Pennsylvania. He has extensive experience providing expert financial advice to individuals and businesses, helping them achieve their goals with smart investments, budgeting, and long-term planning. Dennis is passionate about helping people make the most of their finances.