It is always essential to keep track of your finances. For UAE residents, that includes knowing how to check Ratibi card balance.

Ratibi is a payroll program that pays the salaries of workers who make less than AED 5,000 per month. If you own a Ratibi card, you must know about the Ratibi salary check process.

Fortunately, checking your balance is easy, and there are a few different ways to go about it. This Dbd guide will help you learn how to check Ratibi card balance online. Keep reading to find out more.

How to check Ratibi card balance?

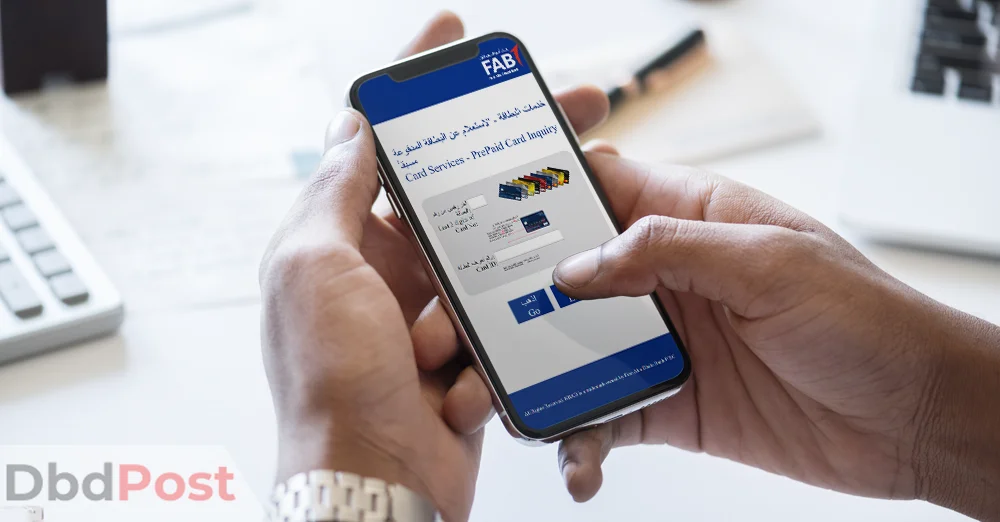

You can easily check Ratibi bank balance from the Abu Dhabi Bank-FAB website. But before you start the balance enquiry, you need to have the FAB prepaid card with you.

Once you have the card, you are ready for the balance check. Follow these steps to check your Ratibi balance in the UAE:

Step 1: Go to the Prepaid Card Enquiry page of the FAB bank website.

Step 2: On the small field top, enter the last two digits of your card number. Your card number is the 16-digit number written in a bigger font on your card.

Step 3: Below that, there is a larger field to enter your Card ID. The card ID is the text written in a smaller font on your card below the card number.

Step 4: After entering the card number and ID in the input fields, click on the “Go” button.

This is all you need to do for the Ratibi card salary check. Once you have completed these steps, you will be shown the FAB balance.

If the card number or ID you entered were incorrect, it would not show the balance. You will instead be shown a message that says, “Invalid Card Key or Card No.”

If you see this message, you need to click the “Back” button. Then input the card number & ID and try the Ratibi card balance inquiry again.

Related info: If you don’t know how to check your FAB balance, check our detailed Dbd guide on – How to check FAB bank balance

Why should you check my Ratibi card balance?

There are many reasons why you should keep track of your Ratibi balance. First and foremost, it will help you stay on top of your finances.

You must be familiar with the first rule of personal finance, which is to live within your means. Knowing your Ratibi salary card balance will make it easier to budget and avoid overspending.

Additionally, if you ever lose your card or it is stolen, you can quickly check your balance to see how much money is missing.

Finally, you can spot any fraudulent activity on your account by checking your balance regularly. The card is highly secure, but you never know when things might take a wrong turn.

If you see an unauthorized transaction on your Ratibi card, you should immediately report it to the bank. You can also go to a branch in person if you have to.

After you report, it is up to the bank to find the cause of the problem. The sooner you report, the easier it will be for the bank to resolve the issue and refund your money.

We recommend checking your Ratibi balance at least once a week. This will help you stay on top of your finances and quickly catch unauthorized transactions.

Of course, you can check your balance more often if you want. The Ratibi online balance inquiry is free, and no limit has been placed on how often you can check it.

What are the benefits of FAB Ratibi prepaid card?

The FAB Ratibi can be used for various purposes. You can make utility bill payments, withdraw cash, and secure your money by never having to carry cash.

Besides these, the service is highly beneficial for the following reasons:

- No bank account needed

A bank account is not required to get the Ratibi card. A Ratibi card is available for employees who earn up to AED 5,000 salary monthly without opening an account. [1]First Abu Dhabi Bank, “Ratibi Prepaid Card, https://www.bankfab.com/en-ae/personal/prepaid-cards/ratibi#:~:text=No%20bank%20account%20required”

- Free balance inquiry

Ratibi card balance check online is very convenient. You can access it from the FAB website with no sign-up required.

- Easy to use

The FAB/NBAD Ratibi is like a credit card but has no strings attached like normal bank-linked cards. You can also use Ratibi cards in the VISA or Mastercard networks globally. [2]First Abu Dhabi Bank, “Ratibi Prepaid Card, https://www.bankfab.com/en-ae/personal/prepaid-cards/ratibi#:~:text=Can%20be%20used%20at%20VISA/MasterCard%20networks%20worldwide”

- No monthly charges

No monthly fees are to be paid for using the Ratibi card. You can apply for it and use it for free.

- ATM cash withdrawal

You can use the extensive ATM network available in UAE to take out cash. There is no limit to how much you can withdraw. [3]First Abu Dhabi Bank, “Ratibi Prepaid Card, https://www.bankfab.com/en-ae/personal/prepaid-cards/ratibi#:~:text=Free%20access%2024/7%20to%20the%20largest%20ATMs%20and%20CDMs%20network”

- Free accident insurance

The Ratibi card includes free accident insurance of up to AED 25,000. That isn’t a lot, but it can be beneficial during a crisis. [4]First Abu Dhabi Bank, “Ratibi Prepaid Card, https://www.bankfab.com/en-ae/personal/prepaid-cards/ratibi#:~:text=Free%20personal%20accident%20insurance%3A%20In%20the%20event%20of%20death”

- Free SMS alerts for salary

You can get free SMS alerts for your salary credit to the Ratibi card. This is a great way to track whether you received your salary on time. [5]First Abu Dhabi Bank, “Ratibi Prepaid Card, https://www.bankfab.com/en-ae/personal/prepaid-cards/ratibi#:~:text=Free%20SMS%20alerts%20on%20every%20salary%20credit”

Related Stories

- List of Mashreq bank ATM’s & branches in UAE

- Check out this list of Abu Dhabi Islamic bank ATM’s & branches in UAE, where you can find the nearest ATM or branch to you.

- List of ADCB branches and ATM’s in UAE

- List of First Abu Dhabi Bank (FAB) branches & ATMs in UAE

- Check out this list of Emirates NBD branches & ATM’s in UAE, where you can find the nearest ATM or branch to you.

Video Tutorial

FAQs

What is FAB Ratibi card?

FAB Ratiabi card is one of the prepaid cards in which employees earning under AED 5,000 can receive their salary. It enables employers to make automatic salary payments each month to their employees.

How can I activate my FAB Ratibi card?

You must fill out a Ratibi application form, and employee details excel sheet to request a card. Then fill up an iBanking form to obtain online card management access and submit it to your nearest branch.

How do I check the balance on my FAB card?

For Ratibi bank salary check, click here. You must enter your card number and ID to see your balance and transactions.

How can I check my ATM balance?

FAB Ratibi card is a great way for employees to receive their salary without opening a bank account. It is also beneficial for employers as it enables them to make automatic salary payments each month.

Final thoughts

FAB Ratibi card is a great way for employees to receive their salary without opening a bank account. It is also beneficial for employers as it enables them to make automatic salary payments each month.

The card can be used globally in the VISA or Mastercard networks. With free accident insurance, free balance inquiry, and unlimited ATM cash withdrawals, it can be of tremendous help.

It is essential to check Ratibi card balance to understand your financial situation. Ratibi card balance check must also be done through the website to confirm and prevent rare fraud cases.

Overall, the FAB Ratibi card is a great option for employers and the employees.

- 107shares

- Facebook Messenger

About the author

Arijit Negi

Arijit Negi is an expatriate living in Dubai for 18 years. He completed his degree in Master of Arts in Journalism from the University of Mumbai. Arijit focuses on providing helpful guides and information for ex-pats living in UAE and visitors to the UAE.

![Highest Paying Companies in Dubai in [year] highest paying companies in Dubai - feature image](https://dbdpost.com/wp-content/uploads/2021/12/highest-paying-companies-in-Dubai-feature-image-150x150.jpeg)

![Top 10 Highest Paying Jobs in Dubai in [year] highest paying jobs in dubai-feature image](https://dbdpost.com/wp-content/uploads/2021/12/highest-paying-jobs-in-dubai-feature-image-150x150.jpeg)