TRN verification in Dubai confirms the validity of a Tax Registration Number issued by the Federal Tax Authority (FTA). To avoid penalties and fines, businesses must ensure their TRN is valid and current.

The TRN verification process is essential for businesses to validate their authenticity. The TRN number verification is vital for businesses dealing with other VAT-registered entities.

This Dbd guide will provide the necessary information to verify, check, and report fake TRN in Dubai. We will cover everything about tax verification UAE.

TRN verification: Why is it necessary?

Tax Registration Number (TRN) is a unique 15-digit identifier assigned to every business or individual registering for Value Added Tax (VAT) in Dubai. The TRN is a mandatory requirement for VAT compliance and must be mentioned on all tax-related documents. [1]FTA, “Need of VAT, https://tax.gov.ae/en/taxes/Vat/vat.topics/registration.for.vat.aspx#:~:text=A%20business%20must,of%20AED%20187%2C500.”

TRN verification in UAE is essential as businesses must mention it in invoices, VAT returns, and tax credit notes. The FTA TRN verification ensures valid TRN and registered business under the correct name and legal structure.

Moreover, UAE TRN verification helps to prevent fraudulent activities related to VAT. It prevents businesses from misusing or providing fake TRNs, which can lead to tax evasion and government revenue loss.

Other known advantages of TRN verification in Dubai are:

- TRN enables accessible communication between the supplier and purchaser of goods and services.

- Obtaining a TRN is essential for organizations seeking to claim back the tax.

- Easily manage tax invoices.

By ensuring that all registered businesses comply with VAT regulations, TRN verification FTA helps to promote transparency and trust in the market.

How to verify your TRN in Dubai?

You can easily perform federal tax authority TRN verification number online via their website.

To complete the online TRN verification, visit the FTA website and click the “TRN Verification” option.

Here’s the step-by-step process for the TRN number check.

Step 1: Go to the Federal Tax Authority (FTA) website.

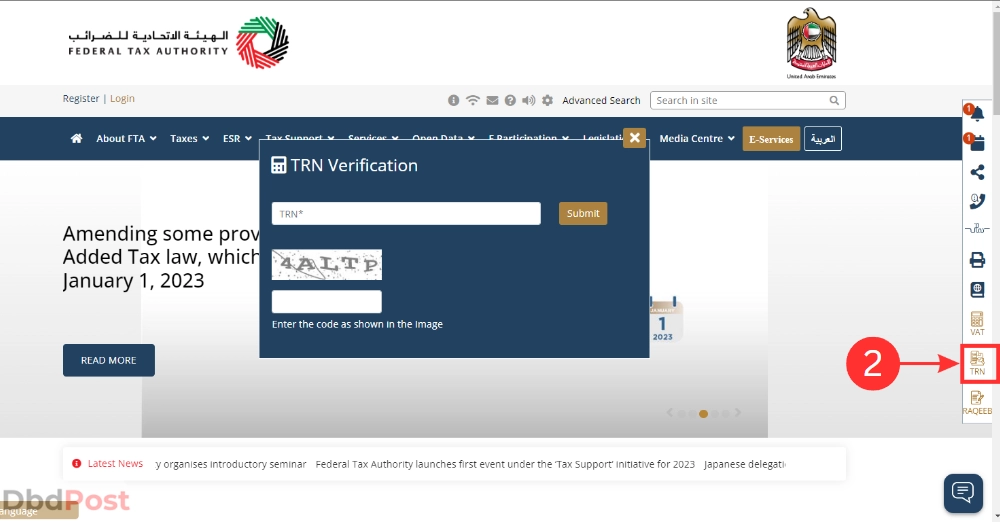

Step 2: Click on the TRN icon in the menu bar on the left. A pop-up for TRN VAT verification will appear.

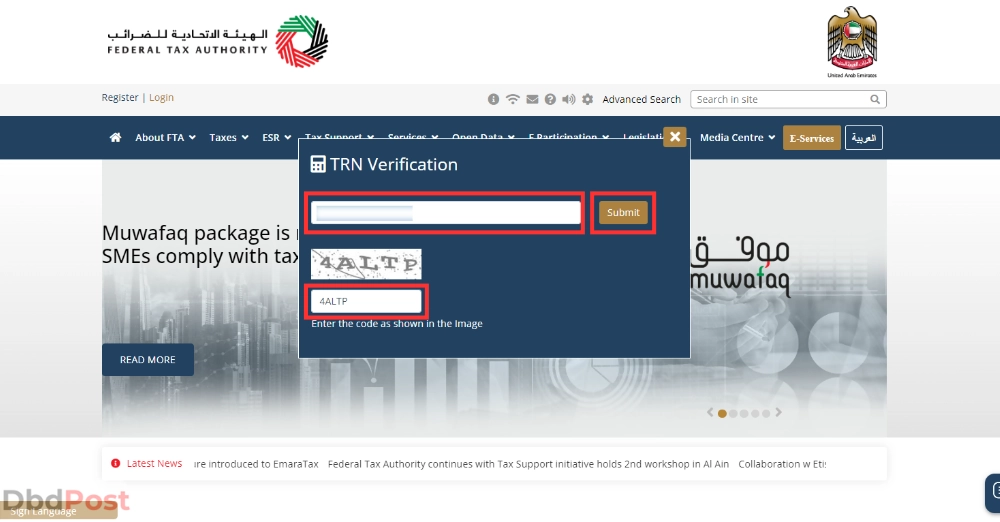

Step 3: Enter the TRN number and code in their respective fields and press “Submit.”

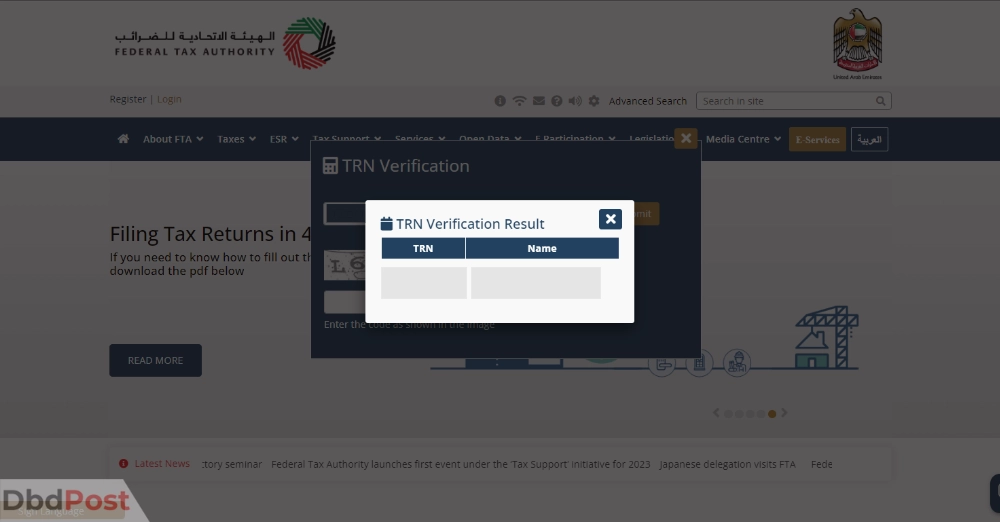

Step 4: A pop-up of business will appear with the registered name and TRN number.

Congratulations, you’ve successfully verified the TRN number in Dubai. However, you won’t see the business name if it’s not a valid tax registration number.

Generally, a fake TRN number has the following properties:

- TRN number is above or below 15 digits.

- TRN number does not start with “100.”

- Provided by untrustworthy sources or in an unsolicited manner.

How to report a fake TRN?

If you suspect a business or individual uses a fake TRN in Dubai, it must be reported to the relevant authorities immediately.

The UAE government takes tax fraud seriously and encourages individuals to report suspicious VAT-related activities. Reporting a fake TRN can help prevent tax evasion and protect the integrity of the VAT system.

To report a fake TRN, contact the Federal Tax Authority (FTA) via their toll-free number or email them. You can also visit their office in Dubai to make a complaint.

It is advisable to provide as much information as possible, including the name and contact details of the business or individual. [2]UAE government, “FTA contact, https://tax.gov.ae/en/default.aspx#:~:text=Central%20Park%20Business,tax.gov.ae”

Contact: +97180082923

Email: info@tax.gov.ae

Location: Central Park Business Towers, DIFC, P.O. Box 2440, Dubai

Map: Get direction

Related Stories

- If you’re in need of a police clearance certificate in Dubai, our comprehensive guide provides a step-by-step guide on how to obtain one.

- Check out our guide on how to get an MRN number in Dubai – here.

- Find out everything you need to obtain a police clearance certificate in Abu Dhabi with our guide.

- To ensure you’re calculating your gratuity correctly when working in the UAE, check out our guide on how to calculate gratuity in UAE.

FAQs

How do I verify TRN in Dubai?

For TRN verification in Dubai, visit the Federal Tax Authority (FTA) website and enter it to check its validity. You must enter the TRN number checking and solve the security code.

Can I check my TRN number online from my mobile?

Yes, you can perform VAT registration number verification online from a mobile in Dubai. Browse the FTA website from your mobile browser and follow the abovementioned steps for TRN number status.

How long does it take to complete TRN verification in Dubai?

The TRN verification process in Dubai is fast and can be completed online within a few seconds. An invalid TRN number won’t show the business name with blank information.

Is TRN verification mandatory for all businesses in Dubai?

TRN verification is mandatory for all businesses registered for Value Added Tax (VAT) in Dubai. This is to ensure compliance with UAE VAT laws and prevent fraudulent activities related to VAT.[3]FTA, “Need of VAT ,https://tax.gov.ae/en/taxes/Vat/vat.topics/registration.for.vat.aspx#:~:text=A%20business%20must,of%20AED%20187%2C500.”

Can anyone have more than one TRN number?

As the Federal Tax Authority issues, each taxable person can only hold one Tax Registration Number (TRN) for VAT purposes. Submitting duplicate applications for TRNs is not allowed, and if discovered must be solved immediately.

In conclusion, TRN verification in Dubai is essential for businesses with VAT registration. It ensures that the TRN mentioned on tax-related documents is valid and registered under the correct name and legal structure. We hope this Dbd guide on UAE TRN verification has been helpful.

- 107shares

- Facebook Messenger

About the author

Arijit Negi is an expatriate living in Dubai for 18 years. He completed his degree in Master of Arts in Journalism from the University of Mumbai. Arijit focuses on providing helpful guides and information for ex-pats living in UAE and visitors to the UAE.

![10+ Best Dubai Dating Apps & Sites in [year] feature image - dubai dating apps - people dating on a phone](https://dbdpost.com/wp-content/uploads/2022/07/feature-image-dubai-dating-apps-people-dating-on-a-phone-150x150.webp)

![How to Get Job in Canada from Dubai? ([year] Updated Guide) feature image - how to get job in canada from dubai](https://dbdpost.com/wp-content/uploads/2022/08/feature-image-how-to-get-job-in-canada-from-dubai--150x150.webp)