You can use a self-withdrawal check to move money from one bank account to another. This type of check is for personal use and is written to transfer money from your or joint bank accounts to other accounts in your financial institution or another bank.

Writing a self-withdrawal check correctly is important to avoid problems and get the money you want. If you’re writing a personal check for a self-withdrawal, taking precautions can help ensure the check works and you receive your money.

The Dbd guide helps you understand the process on How to write a check for self-withdrawal and guide you through the steps of issuing a self-withdrawal check.

What is a self-withdrawal check?

Self-withdrawal checks are like a special type of check you write for yourself. They are a good way to have control over your money.

When you write your check, you have more options for using your money. You can write them whenever and wherever you want. This helps you get your money quickly and safely, especially when traveling or away from your bank.

However, some banks may treat self-withdrawal checks differently than regular checks. This can make banking procedures confusing.

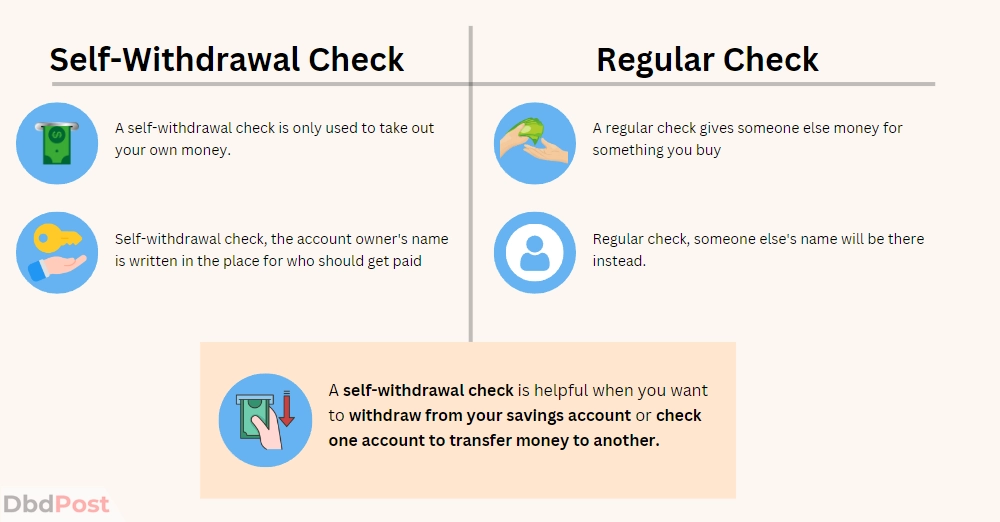

Difference between a self-withdrawal check and a regular check

A self-withdrawal check is helpful when you want to withdraw from your savings account or check one account to transfer money to another.

A regular check gives someone else money for something you buy. But a self-withdrawal check is only used to take out your own money.

On a self-withdrawal check, the account owner’s name is written in the place for who should get paid. On a regular check, someone else’s name will be there instead.

Conditions to write a self-withdrawal check

Nowadays, there are faster options than writing a check to receive funds.

However, sometimes it can be an issue when you cannot cash the amounts to pay your bills.

You can issue this check in the following cases:

- To withdraw funds from your account or to transfer them from one account to another

- As emergency cash when you are traveling or going somewhere

- In case your ATM, debit card, or even the bank’s app is not functioning.

Steps to writing a self-withdrawal check

To fill out a self-withdrawal check, you must be precise, accurate, and neat. Filling out the check correctly is essential to avoid errors, such as writing the wrong amount, adding extra funds, or misspelling the recipient’s name.

Follow these steps when filling out a self-withdrawal check: [1]My Credit Union, “What is on the back, https://mycreditunion.gov/life-events/checking-credit-cards/checking/balancing-checkbook”

Step 1- Ensure that your bank account has sufficient funds to withdraw moving and transfer funds to. If you write a check for more money than you have in your bank, the check will bounce. You could get in legal trouble if this happens.

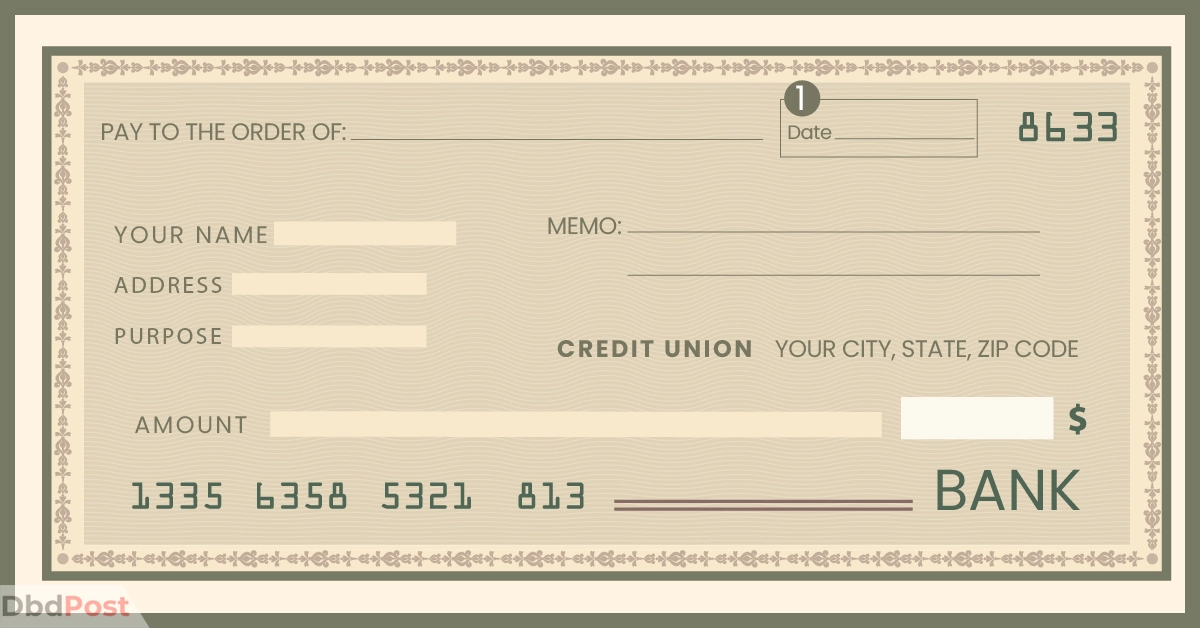

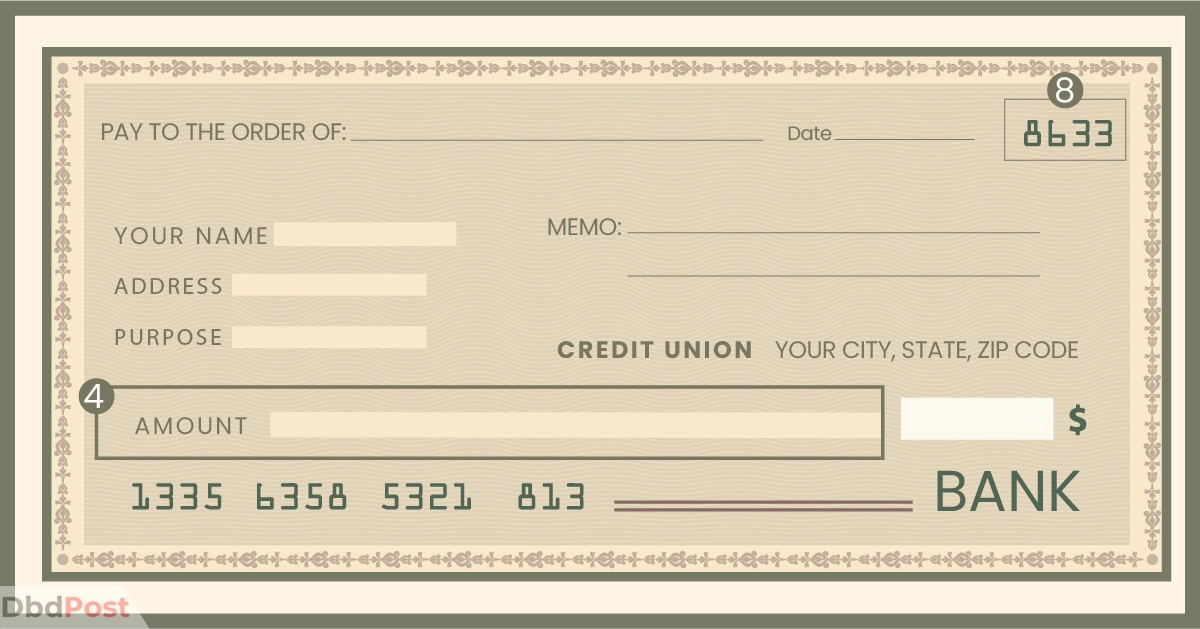

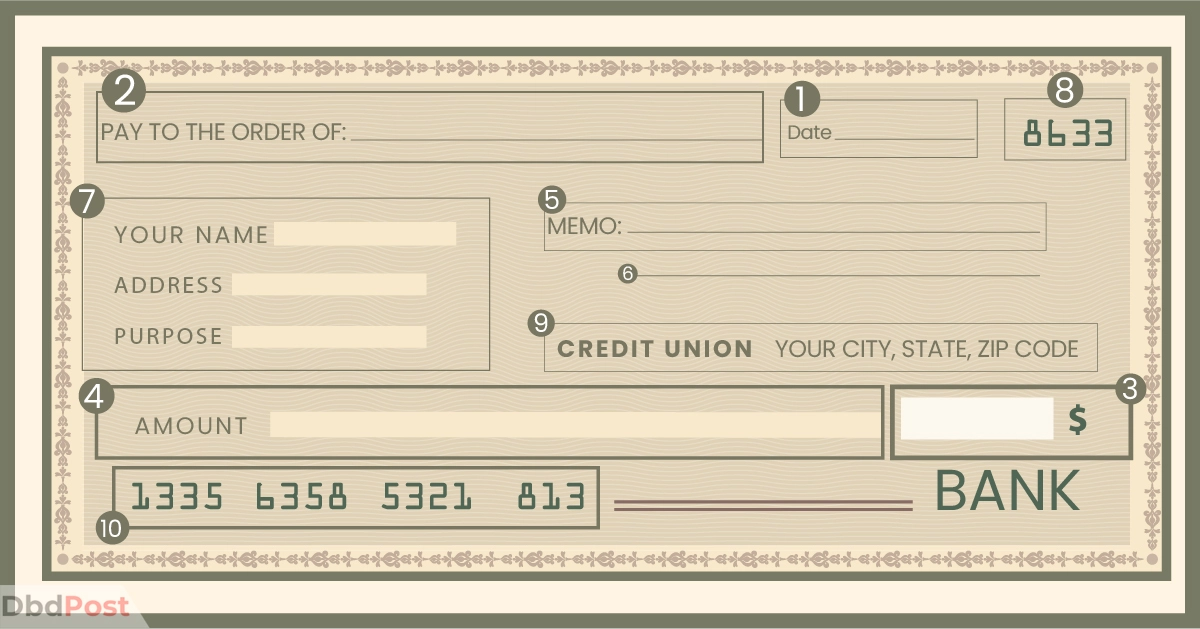

Step 2– Mention the correct date in the top right corner box, which can be either the same day or another date. The check date should be written in month, day, and year.

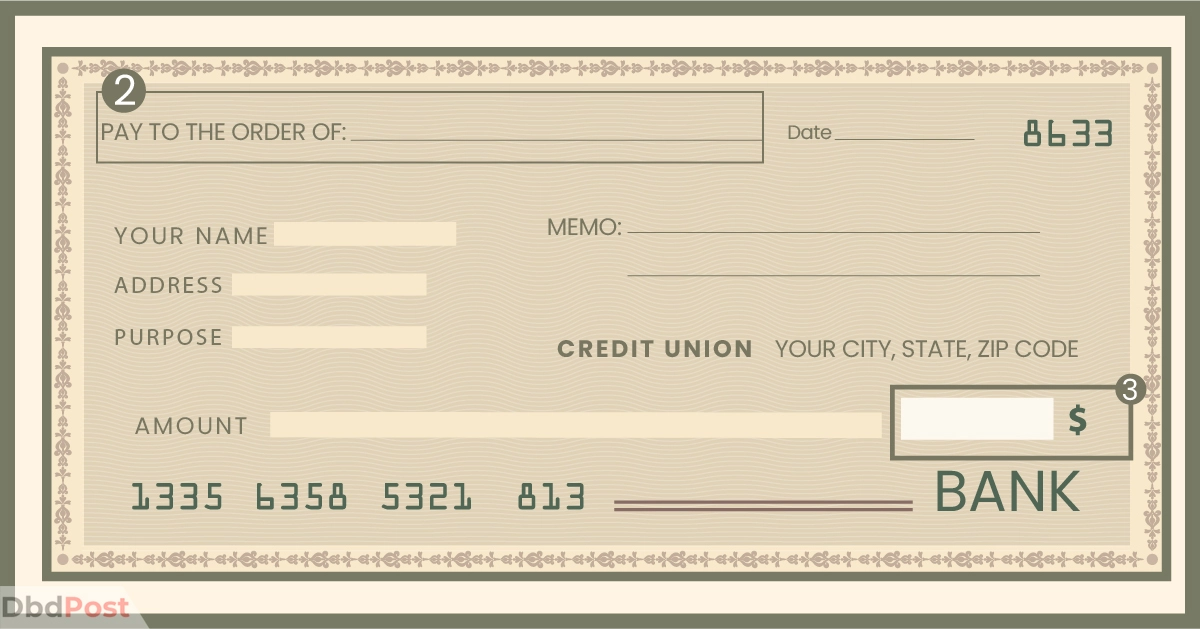

Step 2– In the pay to the order section, you must write your name as the payee.

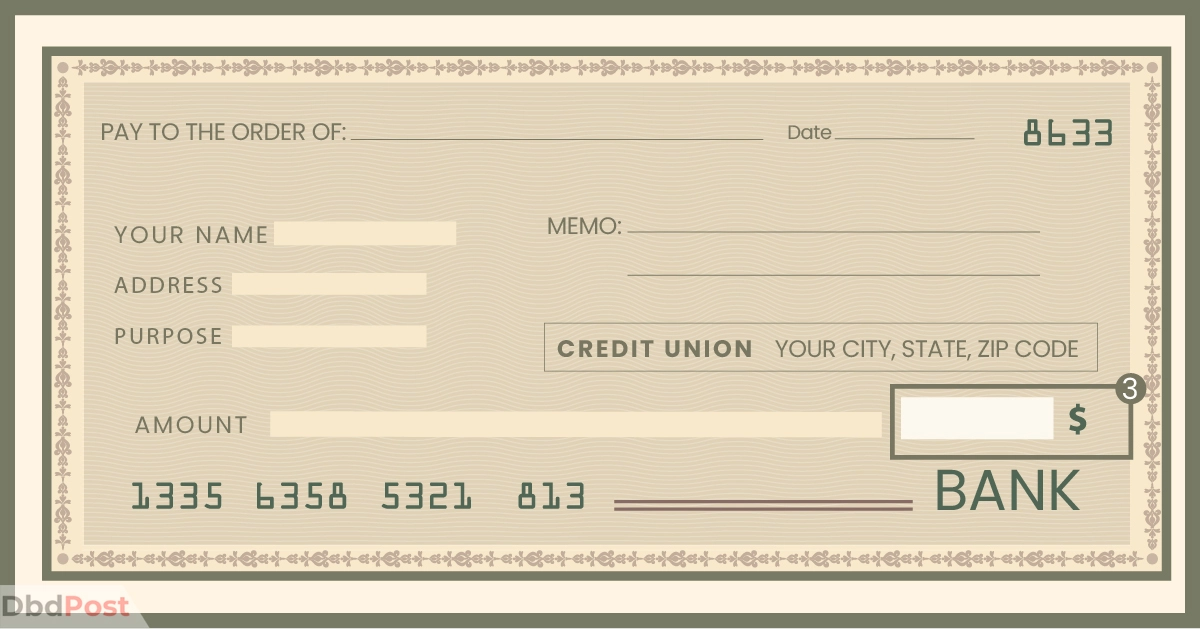

Step 3– Fill up the correct amount that you want to withdraw cash in numbers in the box next to the dollar symbol.

Step 4– Under the box that says how much money one account to another you are paying, write the same amount in words.

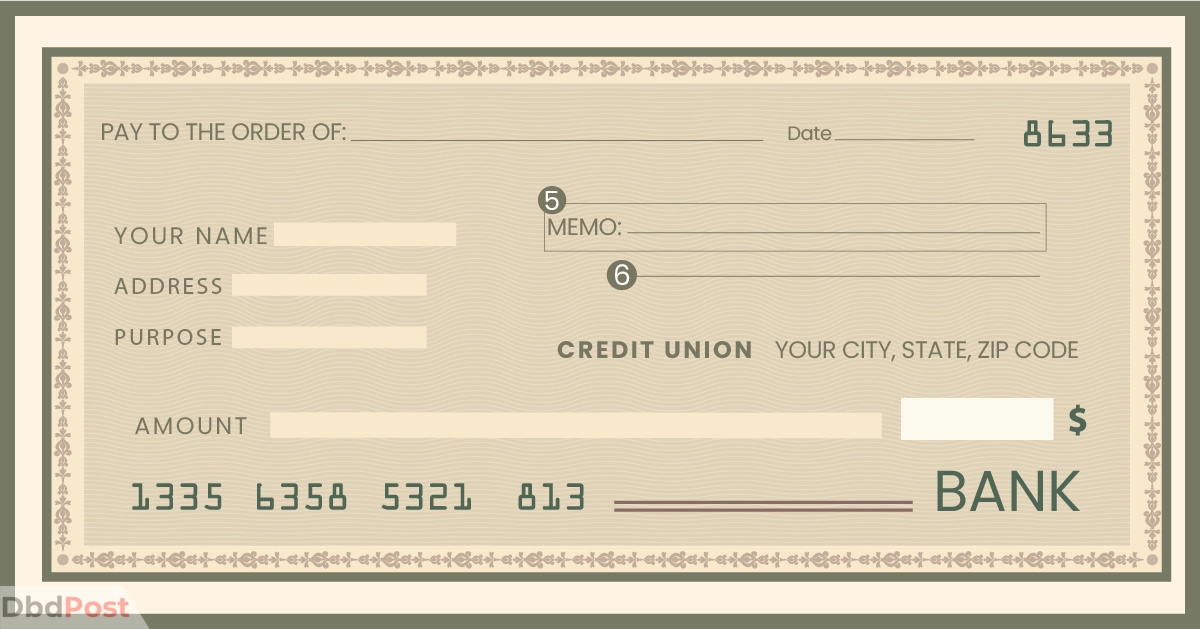

Step 5– Signature: After writing all the details, sign at the signature line with your signature and provide any additional information needed.

Step 6- Use the memo section to keep track of business in one bank account and what you are withdrawing money for in separate accounts.

Step 7– Once you have filled out the check, immediately take it to a bank or credit union. Ask them to give you money for the check. You can even wait a few business days if the due date is still coming.

When writing a check, take your time and make sure everything is correct before signing it. Write the numbers, dates, and your signature neatly so the bank can read them easily.

If the details in the check are unclear, you might have problems depositing the money electronically.

This will help you deposit the check and transfer your money without problems.

Back of the check

Remember to check the back side when you fill out a check. This part of the check is for signing, which is called endorsing.

After writing the check, the person who receives it must sign it to either get cash or deposit it into their bank account.

Precautions to take when writing a self-withdrawal check

Writing a self-withdrawal check requires following some important banking protocols for every single transaction to ensure its safety and accuracy:

- Most importantly, only leave blank spaces on the check or sign it once all the blanks are filled in.

- Additionally, write your words so it is easy to read. That way, everyone can understand what you wrote and avoid fraud. This is especially important for dates and amounts to record the information accurately.

- Keep the check safe in a secure location until you present it at the bank – never leave it lying around. A lost or stolen check might create an issue otherwise.

- Use pen instead of pencil: This is one of the security confirmations that can help you ensure nobody changes the information or steals it.

- Only sign the check after everything is filled out: If someone steals a signed check, it will be hard to prove that you did not write it if your signature is the same as on the check.[2]Annuity, “Security tips, https://www.annuity.org/personal-finance/banking/how-to-write-a-check/”

By taking these simple precautions, you can protect yourself and your business accounts at other banks from financial loss or possible identity theft while withdrawing funds quickly.

Related Stories

- Discover how to complain to Uber Eats and get the resolution you need.

- Get the inside scoop on how to update your signature in Outlook for a professional touch.

- Uncover how to deposit a check on Cash App and conveniently manage your finances – here.

- Discover how to write a void check and provide accurate payment information.

- Learn how to track a phone using IMEI online for added security and peace of mind.

FAQs

Is it illegal to write a check for oneself?

No, it is perfectly legal to write a check for oneself. It’s important to remember that the payee, when writing checks should always be you or someone you are directly paying money to.

What information do I need to include on a self-withdrawal check?

You need to include your name as the payee, the date of the deposit or check, a memo (if desired), and the amount. You also need to sign at the bottom for it to be processed by the bank.

Can I write a self-withdrawal check for any amount?

Yes, you can write a self-withdrawal check for any amount in your account.

However, banks may restrict the maximum and minimum amounts of transfer funds you can withdraw from the bank or deposit into a personal account. [3]Santander Bank, “What is the maximum amount, … Continue reading

Are there any fees associated with writing a self-withdrawal check?

According to banking protocol, banks usually do not charge fees for such transactions as cash or writing a personal check.

However, if your bank has insufficient funds, they might charge you a fine. [4]Bank of America, “Insufficient funds, https://bettermoneyhabits.bankofamerica.com/en/personal-banking/avoid-bank-fees”

How do I record a self-withdrawal check in my checkbook or financial records?

When you pay by check, write down the check number at the top right corner. Write down the date too. This will help you remember which checks you have used and when to order new ones.

Write what this payment was for in the “Transaction” or “Description” column. Then, write down how much money was paid in either the withdrawal or deposit column, depending on whether you gave away or received it.

How to either withdraw money in cash or how to write a check for self-withdrawal might be a bit confusing for people.

However, by following the above guidelines and precautions, you can make sure to fill out a self-withdrawal check so that the process of withdrawing money goes smoothly.

- 107shares

- Facebook Messenger

About the author

DbdPost Staff is a team of writers and editors working hard to ensure that all information on our site is as accurate, comprehensive, and trustworthy as possible.

Our goal is always to create the most comprehensive resource directly from experts for our readers on any topic.