The 1095-A form is an IRS tax form used to report information about the Marketplace coverage you had during the previous year. It is also known as the Health Insurance Marketplace Statement.

IRS form 1095-A is a tax form issued by the Health Insurance Marketplace to individuals who have enrolled in a health insurance plan through the Marketplace. Taxpayers can get it online through the Marketplace website or by contacting the Marketplace Call Center.

This guide will provide taxpayers with information on what is 1095-A form and who needs it. It will also provide guidance on how to get 1095-A form online. This will help taxpayers complete the tax filing process using this form.

What is the 1095-A form?

Form 1095-A is a tax form issued by the Health Insurance Marketplace to individuals who have enrolled in a health insurance plan through the Marketplace. This form provides important information needed to complete your accurate tax return, specifically related to the premium tax credit.

The information from the 1095-A form calculates the amount of your premium tax credit. You need to use this form to match the pre-payments of the premium tax credit made on your behalf with the premium tax credit you state on your tax return. [1]IRS, Basic Information about Form 1095-A, … Continue reading

You need to use Form 8962, Premium Tax Credit while filing your tax return to complete this task.

Overall, the 1095-A form plays a critical role in ensuring that individuals and families who purchase health insurance through the Marketplace receive the correct amount of premium tax credit and avoid any penalties for failing to reconcile pre-payments.

Who needs a 1095-A form?

Form 1095-A is a crucial document required to file federal taxes if any household member had a health coverage plan through the Health Insurance Marketplace during the tax year 2022.

This form provides essential information needed to determine the amount of the premium tax credit an individual may be eligible for. It plays a key role in reconciling any advance payments of the credit made on behalf of the taxpayer.

By including details about the health insurance coverage, such as the monthly premium amount and any pre-payments of the premium tax credit, the 1095-A form enables accurate calculation of the premium tax credit and ensures the received credit was correct.

Failing to have the 1095-A form can result in inaccurate calculations of the premium tax credit, potentially leading to overpaying or underpaying taxes.

Hence, it is imperative to have the 1095-A form in hand before filing federal taxes if any household member has a Marketplace plan during the tax year.

This ensures the accurate determination of the premium tax credit and reduces the risk of tax payment discrepancies.

How to get the 1095-A form online?

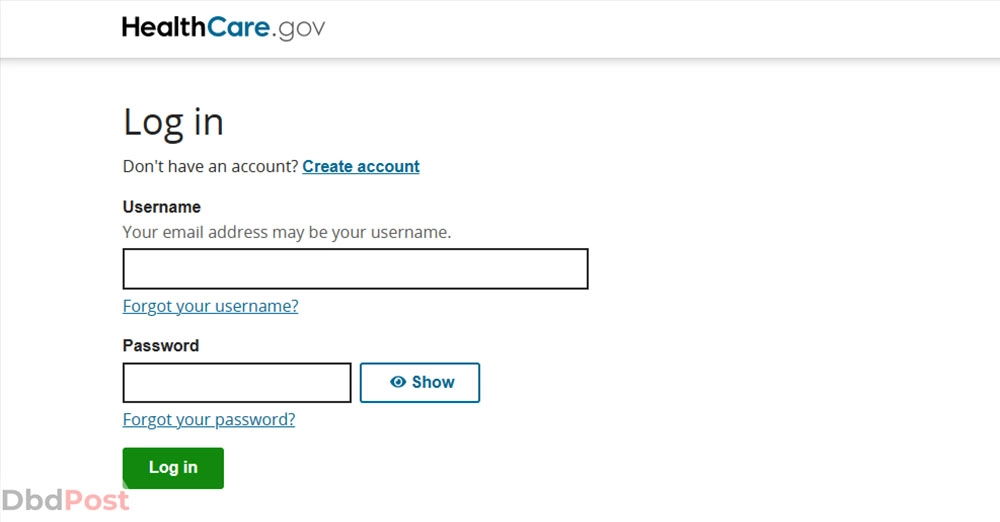

If you purchased health insurance through the Health Insurance Marketplace, your Form 1095-A should be available in your HealthCare.gov account. It will be available by mid-January or February. Follow these steps to get the 1095-A form online: [2] Health care, ” How to find your 1095-A online, https://www.healthcare.gov/tax-form-1095/#:~:text=%3A%C2%A0Your%201095,Call%20Center.”

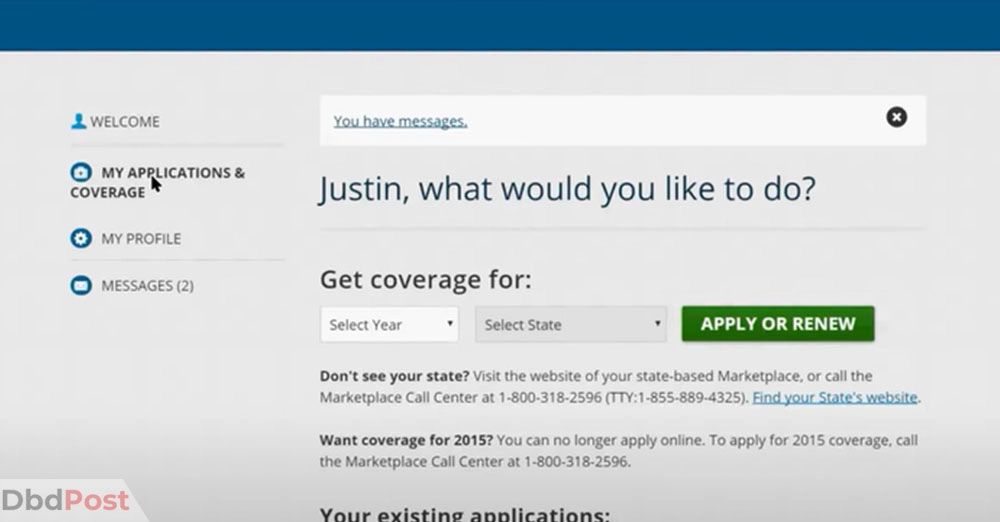

Step 1: Login and access your Health Care account.

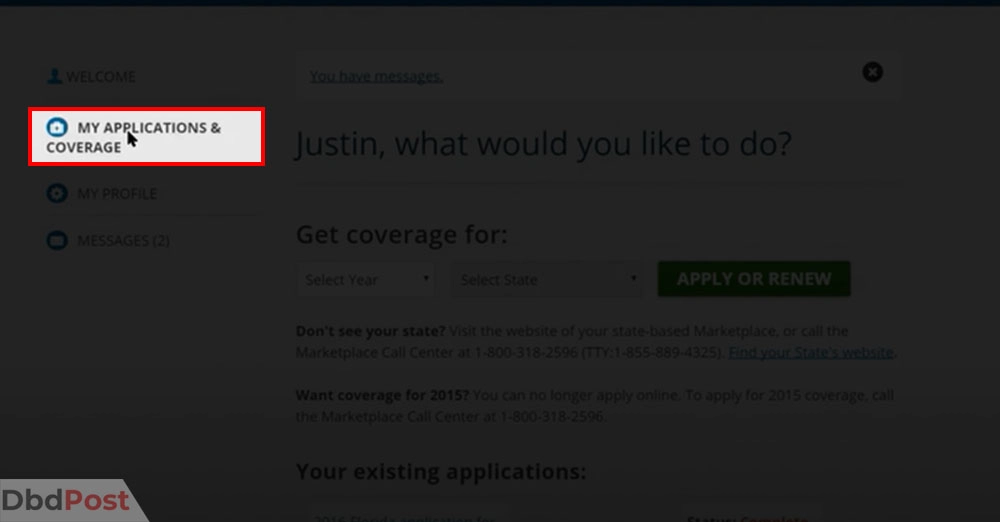

Step 2: Go to “My Applications and Coverages.”

Step 3: Choose your 2022 application from the list. (not your 2023 application)

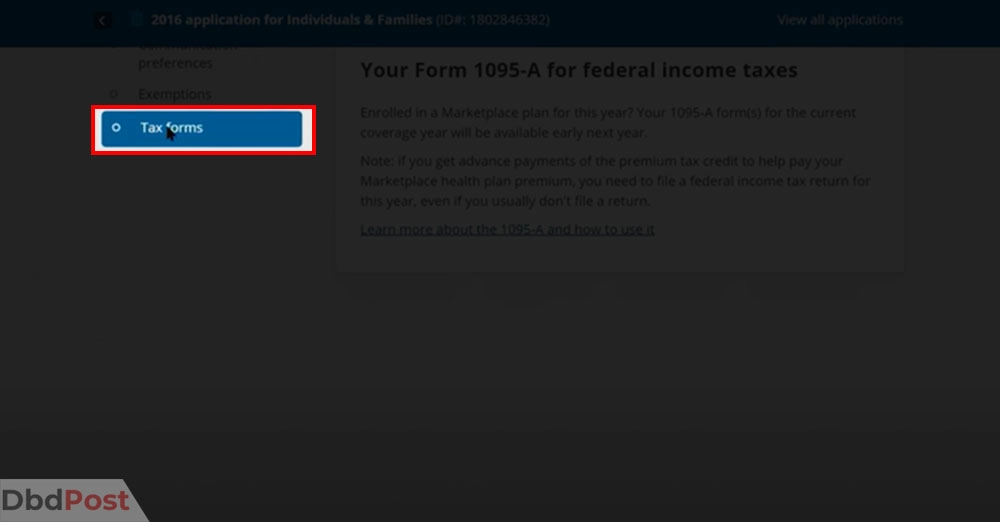

Step 4: Choose “Tax Forms” from the menu on the left.

Step 5: Download all 1095- that’s shown.

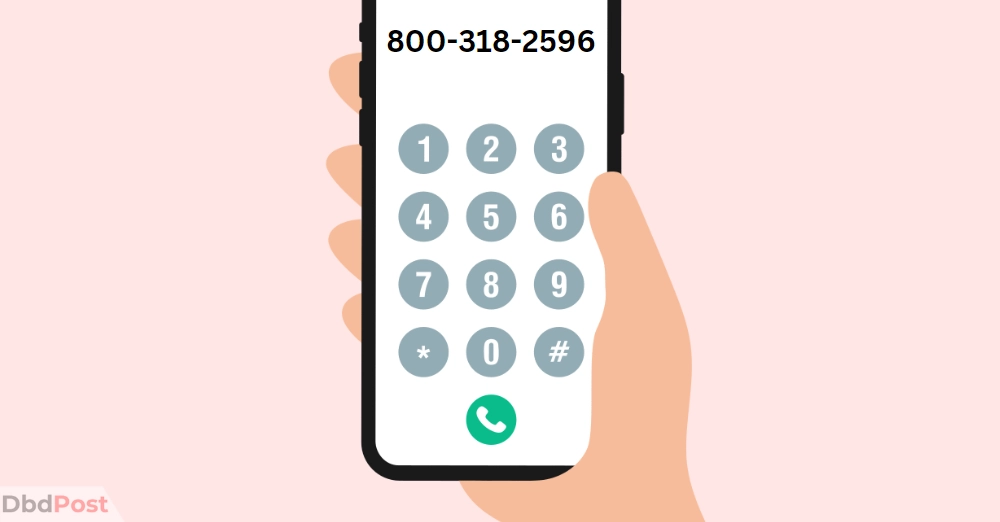

Step 6: If you cannot find your 1095-A form in your Marketplace account, contact the Marketplace Call Center.

What to do if you can’t find your 1095-A form online?

If you cannot find your 1095-A form online, there are steps you can take to obtain a copy.

The first action is to contact the Federally-facilitated Marketplace call center at 800-318-2596. They can assist you in requesting a copy of your Form 1095-A.

It’s important to provide them with the necessary information and follow any instructions they provide to ensure a smooth process.

If your state operates its own Marketplace, you must contact them directly to request a copy of the form.

Each state may have its contact information and procedures for obtaining the 1095-A form, so it’s crucial to find the specific contact details for your state’s Marketplace. They will guide you through the steps required to obtain a copy of your Form 1095-A.

By contacting the appropriate Marketplace, whether it is the Federally-facilitated Marketplace or your state’s Marketplace, you can request a copy of your 1095-A form online.

It’s important to act promptly to ensure that you have the necessary documentation to accurately file your tax return and determine your premium tax credit eligibility.

Common errors to avoid when filing taxes with 1095-A form

Filing taxes with a 1095-A Form can be complex, and it’s essential to avoid common errors that could result in delays or even penalties.

Here are the common mistakes that taxpayers should avoid when filing their tax returns:

- Missing or inaccurate Social Security numbers

- Misspelled names

- Incorrect filing status

- Math mistakes

- Figuring credits or deductions incorrectly

- Incorrect bank account numbers for direct deposit of refunds

- Unsigned tax forms

- Filing with an expired individual tax identification number (ITIN)

It’s important to avoid these errors when filing your tax return to ensure that it is accurate and processed correctly by the IRS. Working with a professional tax preparer or following the instructions carefully will help prevent these mistakes.

Related Stories

- Uncover how to check your Amazon gift card balance and shop with confidence.

- Learn how to complain to FedEx and resolve any shipping issues.

- Discover how to write a void check and provide accurate payment information.

- Find out how to cancel Straighttalk Service Online with our guide.

- Find out how to complain with UPS with our guide.

FAQs

How can I get my 1095-A form online?

To obtain the 1095-A form online, you must log in to your Health Insurance Marketplace account. If you don’t find your 1095-A in your Marketplace account, contact the Marketplace Call Centre. This is how to get the 1095-A form online.

What information do I need to provide to access my 1095-A form online?

To obtain the 1095-A form online, you must provide your personal information, such as name, address, and Social Security number. This is the information required to access the 1095-A form online.

When is the deadline to receive and file my 1095-A form?

You have until January 31 to give Form 1095-A to the Marketplace. Insurers, other coverage providers, and certain employers must also give Forms 1095-B and 1095-C to individuals by January 31. The deadline to file your tax return is typically April 15th of each year.

What should I do if there is an error on my 1095-A form?

You should contact Marketplace to call the mistake to their attention and request a corrected Form 1095-A.

Information on 1095-A is also reported to the IRS, so it is important that you get a corrected form before filing your income tax return.

It is important to ensure you have received your 1095-A form before filing your federal taxes.

The provided step-by-step guide on how to get 1095-A form online will make it easier to access and understand the information on the form.

- 107shares

- Facebook Messenger

About the author

Mark Beck

Mark Beck is an experienced financial advisor with an MBA from the Samuel Curtis Johnson Graduate School of Management at Cornell University. He specializes in tax, investing, creating a healthy budget, strategizing debt pay-off, developing a retirement roadmap, and creating personalized investing plans. Mark is committed to helping his clients secure their financial futures by providing personalized retirement planning advice.

![How to Cancel Propstream: Complete Guide [year] feature image-how to cancel propstream-digital illustration-01](https://dbdpost.com/wp-content/uploads/2023/06/feature-image-how-to-cancel-propstream-digital-illustration-01-150x150.webp)