A tax transcript is a document that shows your current tax year and a summary of your tax return information. It can verify income from last year’s wage and income transcript, obtain a loan or mortgage, and fulfill other financial requirements.

If you need to get a tax transcript online instantly, there are several ways to get it online by using the “Internal Revenue Service (IRS) Get Transcript Online.” You can also get transcripts by mail through the mailing system.

This Dbd guide will explain the methods for your query of “How can I get my tax transcript online immediately?” It also covers the alternative way for you if you do not get an IRS tax transcript online instantly.

What is a tax transcript?

A tax transcript is the form of an official document provided by the IRS, which contains a complete summary of your tax return information. It is important to note that this document is not the same as an actual tax return.

The tax transcripts provide a detailed summary of your financial information, including filing status, adjusted gross income, taxable income, total payments, and refund or amount owed.

Tax transcripts can be used to prove income to obtain a loan or mortgage, verify Social Security benefits, and fulfill other financial requirements.

You might want an instant tax transcript in the following cases:

- Find out how much money you owe: A tax transcript can help determine how much money you still owe to the IRS and when it is due.

- Look at your payment history: A tax transcript can also provide information about your payment history, including deposits and payments made to the IRS.

- Check your income from last year: A tax transcript can show you the wage and income reported on your taxes last year, which can help verify your income for an application.

- See other tax records: A tax transcript also includes other information about your tax documents from your tax return, such as tax payment records and filing history. This also helps in tax preparation.

How can I get my tax transcript online immediately?

To get a tax transcript online instantly, you can follow these simple steps mentioned below:

Step 1: Go to the official website of the IRS

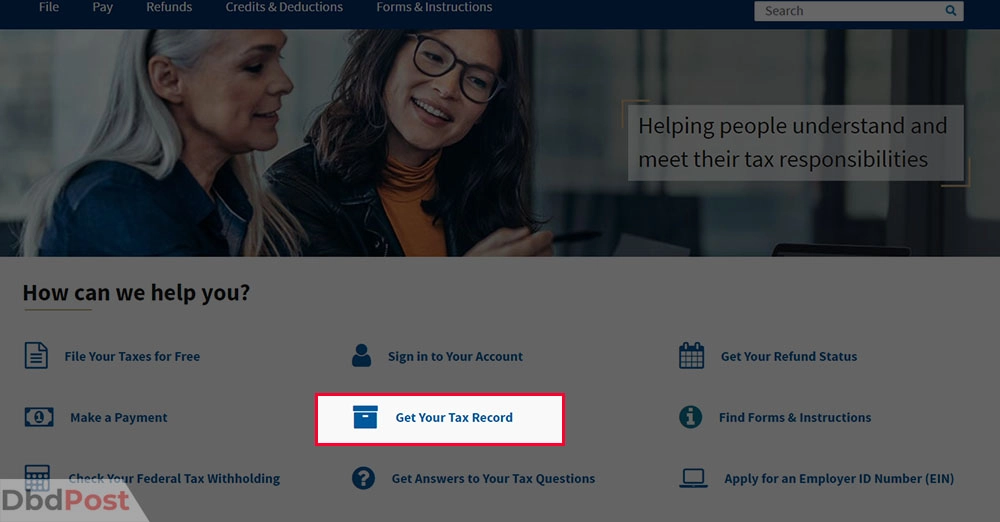

Step 2: Click on “Get Your Tax Record.”

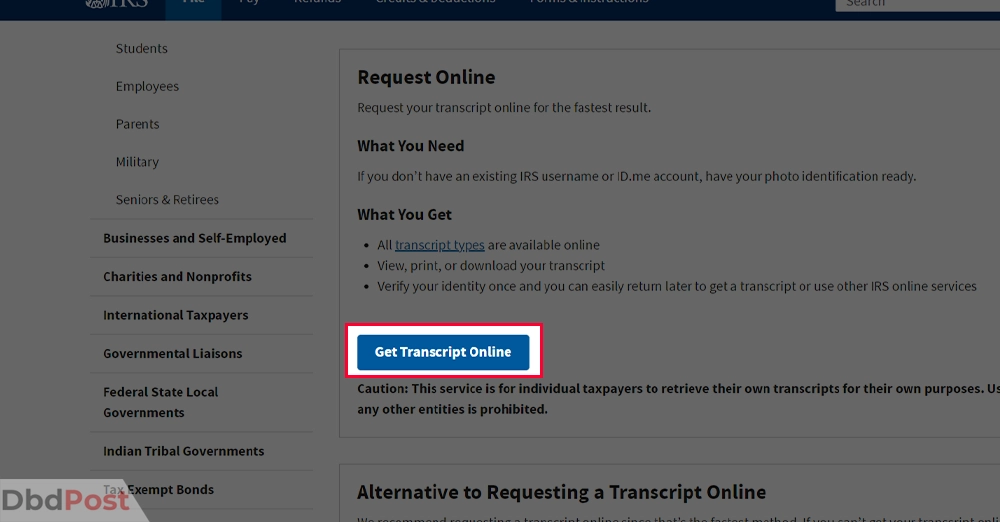

Step 3: Then click on “Get Transcript Online.”

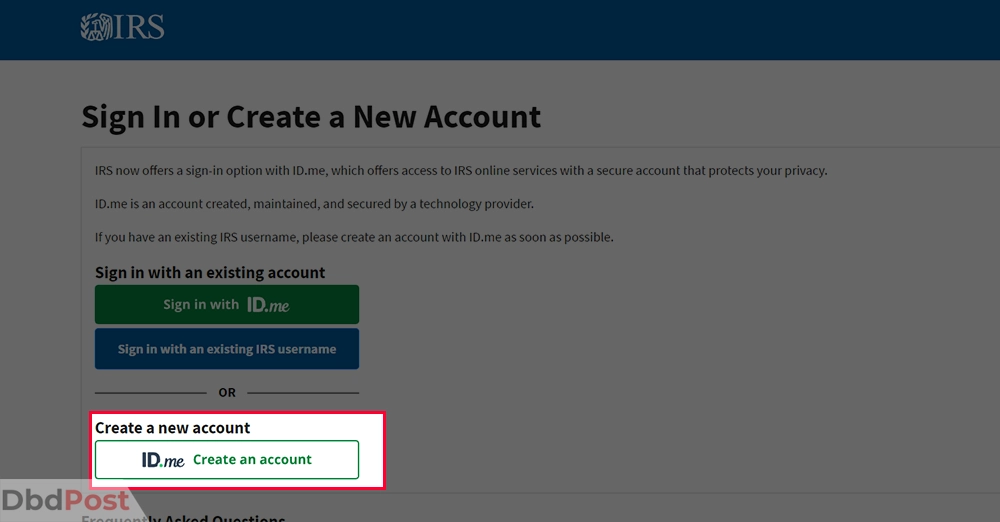

Step 4: Select “Create Account” to create an online account.

Step 5: In the IRS form, enter your information, like Social Security Number, date of birth, address, and zip code. Click “Continue.”

Step 5: Choose the second option on the menu to get a “Return Transcript” for the particular year you want. Click “Continue.”

This method of transcript request is the fastest way to access your IRS tax record.

What information do I need to provide to get my tax transcript online immediately?

The basic data and information that you need to provide to get IRS transcripts online are as follows:

- Social Security Number (SSN): SSN is required for verification purposes.

- Date of birth: This is used to verify you are the person who is requesting the transcript.

- Street address: This is the address on your most recent tax return filing

- Zip code: This is the zip code associated with your most recent tax return filing.

Once you have provided all this information, you can access your tax transcript online.

How long does it take to get a tax transcript online?

Usually, if you have applied for the IRS tax transcript of taxable income for the previous year then you can access it immediately. [1]IRS, “Request Online, https://www.irs.gov/individuals/get-transcript”

However, it takes 2 to 4 weeks for the IRS to process your tax return and make an electronic tax transcript available if you filed for the current tax year.

Though, this process can even become longer in the following cases:

- In case of refund amount or no balance due: If you owe nothing and requested your tax transcript online, it will take 2 to 3 weeks to be processed.

- Balance due and you paid it with your return: If you already paid your due balance before applying, it might take 2 to 3 weeks for everything to get processed.

- Balance due and you paid right after submitting the return: If you pay the balance after submitting the return, then the timeframe increases to 3 to 4 weeks.

- Balance becomes due, and you didn’t pay: In this case, the IRS will start to work on your return in May. You can ask for a transcript by the end of that month.

What if I cannot obtain my tax transcript online immediately?

There are alternative methods if you cannot obtain a tax transcript online.

You can choose to get the IRS transcript by mail. If you want to ask for a transcript in the mail, make sure you have the original return address that is on your most recent tax return.

Usually, the tax transcript when your tax returns are processed will take 5 to 10 business days to process and deliver to your location.

You can request the IRS tax return transcript to deliver to you by mail by calling their automated phone tax account transcript service at 800-908-9946.

Related Stories

- Learn how much does it cost to get a CDL and know every cost associated with it.

- Get the scoop on how to complain to Starbucks and have your concerns addressed.

- Uncover how to deposit a check on Cash App and conveniently manage your finances.

- Learn how to check storage on Mac and optimize your device’s performance – here.

- Uncover how to check your Amazon gift card balance and shop with confidence.

FAQs

What is a tax transcript?

A tax transcript is an official document provided by the Internal Revenue Service (IRS) which contains a summary of your tax return information. It is important to note that this document is not the same as an actual tax return.

Why would I need a tax transcript?

Tax transcripts provide a convenient way to verify your financial information and can be used in many situations.

It can help you prove income when applying for loans, mortgages, Social Security benefits, and other financial services.

How do I request a tax transcript online?

Go to the IRS website and click on “Get Transcript Online.” You will need to make an account using your Social Security number, birth date, address, and zip code.

Once your identity is checked, choose the tax year and type of document you need.

What information do I need to provide to request a tax transcript online?

To request a tax transcript online, you must provide your Social Security Number (SSN), date of birth, address, and zip code. Additionally, you may be asked to answer security questions based on the information provided.

Is there a fee to request a tax transcript online?

No, there is no fee to request a tax transcript online. However, if you choose to receive your transcript by mail, there may be a fee associated.

How long does it take to receive a tax transcript requested online?

If you asked for a copy of your taxable income from the IRS, you can usually get it right away. It normally takes 2 to 4 weeks for the IRS to finish processing your taxes if you sent them in online. But sometimes it may take longer.

You can get your financial information online by asking for a tax transcript. If you cannot get the quickest way to get a tax transcript online you can ask for and submit it through the mail.

We hope that our guide on how can I get my Tax Transcript online immediately was helpful.

- 107shares

- Facebook Messenger

About the author

DbdPost Staff is a team of writers and editors working hard to ensure that all information on our site is as accurate, comprehensive, and trustworthy as possible.

Our goal is always to create the most comprehensive resource directly from experts for our readers on any topic.