A 401K is a retirement savings plan offered by employers. It allows employees to contribute pre-tax dollars toward their retirement.

To check 401k balance online, log in to the online portal of your 401k plan administrator and review its performance. If you can’t get into your account online, call your employer. Make sure they send your quarterly statements to the correct address.

With the help of this Dbd guide, you’ll learn how to check your 401K balance online. You will also know the policies of 401k, including checking the balance online.

How does a 401k plan work?

Employees can choose to put some of their salaries into a 401k account. This money will grow without having to pay taxes. You can take the money out when you retire.

Following are the operating procedure of 401k plans:

Step 1: Your employer offers a 401k plan. You join and pick investments based on time and your risk tolerance. Self-employed people can have solo 401ks but ensure that you are 21 years old.

Step 2: You put money into the plan directly from your old employer’s paycheck before taxes. Your former employer may match or add more money.

Step 3: The money you put in is invested and can grow or shrink. Contributions and earnings increase tax-free until you take them out.

Step 4: At 59 ½ years old, you can take out money for retirement income. You might have to pay taxes. Depending on your age, you must take out a minimum amount. [1]IRS, “Operating a 401(k) plan, https://www.irs.gov/retirement-plans/operating-a-401k-plan”

With the help of this plan, an employee benefits security administration for retirement plan providers. This long-term investment helps make informed decisions for a person to choose investment options.

Setting up an online account

To check your 401(k) balance through online access, you first need an online Income Revenue Service(IRS) account. Follow these simple steps to create your account:

Step 1: Go to the official website of the IRS.

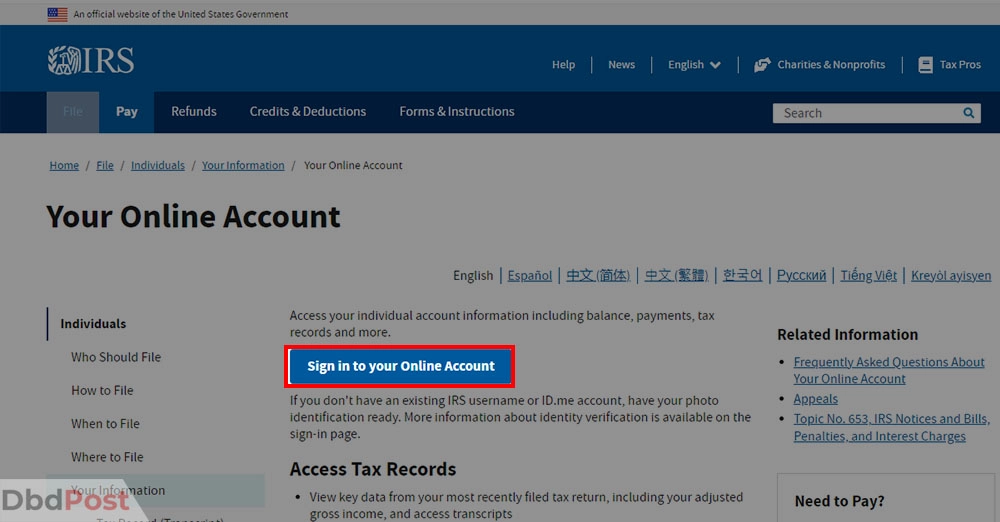

Step 2: Click on “Sign in to your account,” and you will be redirected to a new page named “Your Online Account”

Step 3: Again, click “Sign in to your Online Account,” and you will be on the account creation page.

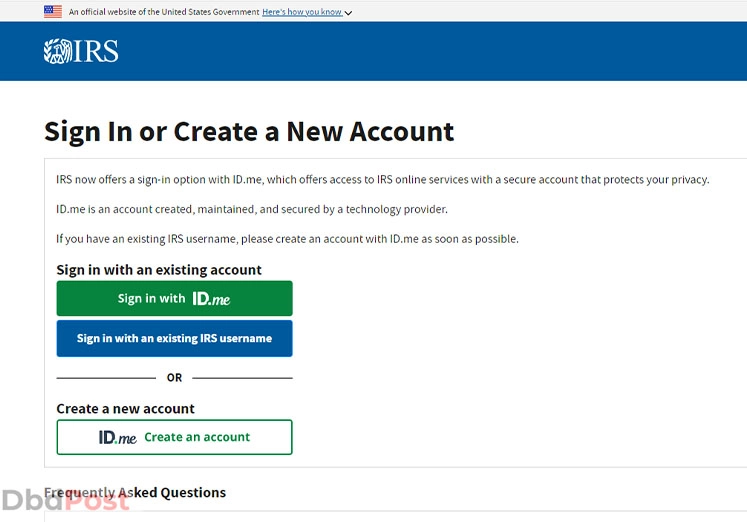

Step 4: Select “Create an Account” to create an online account.

Step 5: In the IRS form, enter your information, like Social Security Number, date of birth, address, and zip code. Click “Continue.”

Logging in to check your 401k balance

Step 1: Visit the official website of the IRS and click on Sign in with an existing IRS username.

Step 2: Enter the username and password you created when creating a 401k online account. Click “Sign In.”

Step 3: You can view your 401K balance and other information after signing in.

You must ensure that you have a strong password in your IRS online account. This is because:

• It helps to keep your account secure from any unauthorized access.

• It allows you to check your 401k balance online safely and securely.

Understanding your 401k balance

Your 401(k) summary depends upon the information that your employer provides to IRS. The summary will include the following:

- Your current 401k balance

- Name and type of plan

- Eligibility requirements for the plan

- Benefits description and when they are accessible to participants

- Statement on the plan’s maintenance based on the collective bargaining agreement, if any

- Declaration on whether the plan is under termination insurance from Pension Benefit Guaranty Corporation

- Contribution sources to the plan and methods of contribution calculation

- Regulations for terminating the plan

- Claim procedures and remedies for disputed claims

It’s important to understand where your money is invested and how much you are paying.

To interpret what your 401(k) balance statement means, follow the general tips given below:

- Beginning Balance: The money you had in your account at the start of the statement period.

- Your Contributions: The money you put into the account.

- Employer Contributions: The money your employer added.

- Fees: The money taken out of your account for various expenses.

- Your Distributions: The money you took out of the account during the statement period.

- Investment Gain/Loss: Whether your account grew or shrank due to investments.

- Loan Repayments: If you borrowed money from your account, this shows what you paid back.

- Dividends/Interest: The money you earned from investments.

- Ending Balance: The money you have in the account now.

- Vested Balance: The portion of the account that is definitely yours.

- Outstanding Loan Balance: if you have a loan, this shows how much you owe.

Make sure your account statement does not have any discrepancies. If you find so, you should consider contacting previous employers. You even have the liberty to contact the human resources department of your former employer.

Checking your 401k balance on mobile devices

Several mobile applications work as tools to search and view 401k balance online.

You can easily manage and track your 401(k) accounts using these applications.

To get started, follow the steps given below:

Step 1: Download and install the application of your choice on your mobile device.

Step 2: To log into this account, you must first create an account.

Step 3: After signing in, you can view your 401K balance on the application once your employment record has been tracked.

The mobile applications also allow users to add multiple accounts to track their investments more accurately.

These applications offer various features for personal finance, like personalized advice, interactive charts, and other features to manage your finances.

Using a secure Wi-Fi connection is advised while using these apps for performing 401k online balance check. Also, make sure that you log out of your old account when you’re finished.

Related Stories

- Find out everything about conducting free background check online with our guide.

- Learn how to track a phone using IMEI online for added security and peace of mind.

- Learn how to get 1095-A form online and complete your tax filing accurately.

- Find out how to complain to McDonalds and ensure your feedback is heard.

- Uncover how to deposit a check on Cash App and conveniently manage your finances – here.

FAQs

How often should I check my 401k balance online?

It is recommended to check your 401k balance at least once a year. Regular checking will help ensure that your contributions are appropriately managed and that you’re on track for retirement.

What information do I need to access my 401k balance online?

You will need your Social Security Number and a valid email address to access your 401k balance online.

You may also be required to provide additional information, such as your birthdate, employer name, or other identifying information.

Can I make changes to my 401k investments through the online portal?

Yes, you can make changes to your 401k investments through the online portal. You should consult with an experienced financial advisor before making any changes to your 401k plan.

Is there a fee for checking my 401k balance online?

No, the IRS does not charge any fees for checking your 401k balance online. There are no account fees and no hidden fees.

However, if you are consulting with some financial advisor, you may be charged a fee for their services.

How accurate is the online 401k balance information?

Generally, the online 401k balance information should be accurate and up-to-date. However, you can contact your employer for more information if you find any discrepancy in your balance amount.

What should I do if I notice discrepancies in my 401k balance online?

If you notice that your retirement account balance is wrong online, it is important to take action quickly. Talk to your plan provider and explain the problem.

You might also want to talk to a financial advisor or someone from your employer’s HR department for more help regarding your 401k account balance.

In conclusion, it is easy to check 401k balance online. You can look up your account online and read the summary of account information and what’s included. However, if you have confusion, choose a certified financial planner.

- 107shares

- Facebook Messenger

About the author

Mark Beck

Mark Beck is an experienced financial advisor with an MBA from the Samuel Curtis Johnson Graduate School of Management at Cornell University. He specializes in tax, investing, creating a healthy budget, strategizing debt pay-off, developing a retirement roadmap, and creating personalized investing plans. Mark is committed to helping his clients secure their financial futures by providing personalized retirement planning advice.

![How to Cancel Propstream: Complete Guide [year] feature image-how to cancel propstream-digital illustration-01](https://dbdpost.com/wp-content/uploads/2023/06/feature-image-how-to-cancel-propstream-digital-illustration-01-150x150.webp)

![How to Cancel Experian Membership: Full Guide [year] feature image how to cancel experian membership experian logo with cancel button 01](https://dbdpost.com/wp-content/uploads/2023/06/feature-image-how-to-cancel-experian-membership-experian-logo-with-cancel-button-01-150x150.webp)